March 28, 2023

What is NFT? Understanding the World of NFTs

Non fungible token also known as NFTs have become a popular trend in the digital world, especially in the art and collectible markets. In this article we explore the concept of NFTs, their creation process, legal implications, and the reasons behind their low and high values and also popularity. We'll be discussing the risks and challenges that are associated with buying an NFT and their potential impact on the environment.

What is NFT?

An NFT is a digital token representing ownership of a unique digital asset. These assets can range from digital art and photographs to music and videos. NFTs are stored mostly in an ethereum blockchain, ensuring their scarcity and authenticity.

Comparing NFTs and Cryptocurrencies

Although both NFTs and cryptocurrencies utilize blockchain technology, they differ fundamentally in terms of their fungibility. Non-Fungible Tokens or short NFT stands for their uniqueness and have distinct values, unlike fungible assets like Bitcoin and Ethereum which all have the same value. Fungibility ensures a consistent value across units, providing more stability in trading.

History of NFTs

The First ever known NFT Art, Quantum, was created by Kevin McCoy and Anil Dash in May 2014. It features a video clip made by McCoy's wife, Jennifer, but it wasn't until 2017 that NFTs became more widely known due to the launch of the ERC-721 standard on Ethereum. Later The Beeple's "Everydays: The First 5000 Days" is one of the most famous NFT art sales all time, selling for a record-breaking $69 million.

The NFT market experienced an unmatched period of growth from 2020 to 2021, with a remarkable 21,000% surge in nft sales volume compared to the prior year. However the year of 2022 saw a significant downturn with nft floor prices plummeting and sales dropping to nearly one-tenth of their previous year's levels.

Legal Aspects of NFTs

When planning a NFT purchase, buyers do not acquire the copyright to the digital artwork itself, Most of the time the creator or third-party seller retains the right to copy, distribute, modify, and publicly display or perform the artwork. If you sell NFTs of someone's artwork without their consent, you could face allegations of copyright violation, which may lead to legal problems.

Why Do People Buy NFTs?

People invest in NFTs for various reasons, including ownership of the original digital file, interest in the tokenized asset, or learning about blockchain network. People also buy NFTs to support the artists they like, for bragging rights or speculative investment. NFTs can verify the authenticity of digital asset or track their ownership over time acting as a digital signature.

How do you buy NFTs?

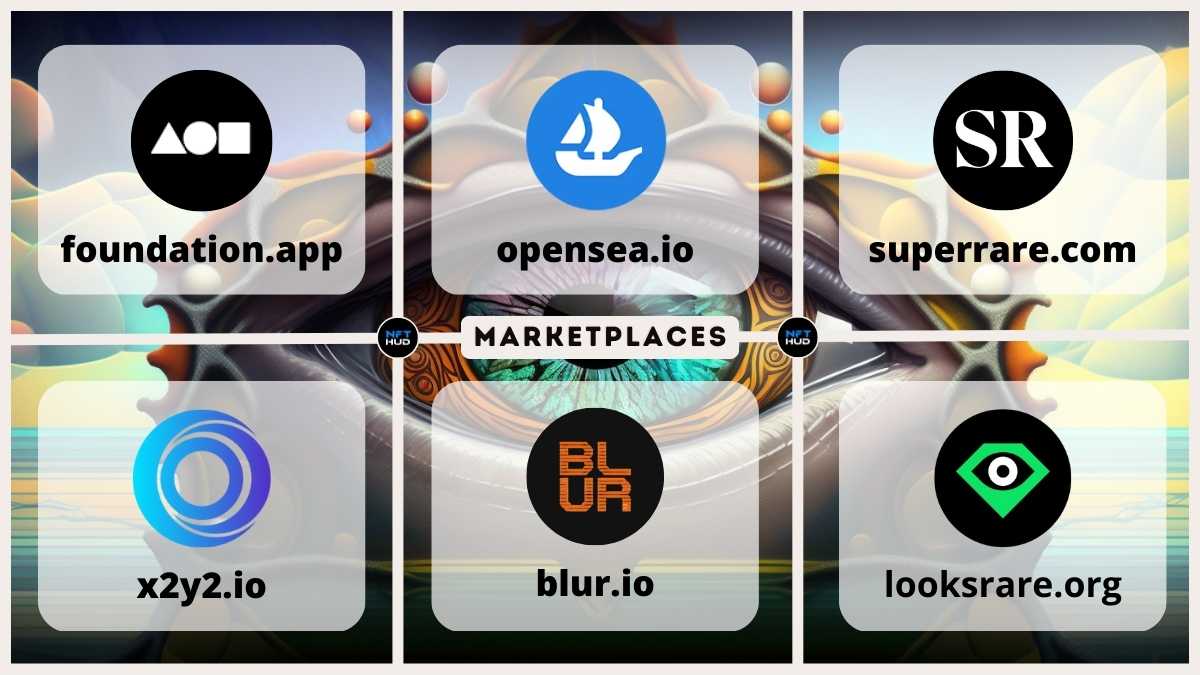

To buy NFT, you need a digital wallet for storing NFTs and cryptocurrencies (usually Ether or other currencies your NFT provider accepts) to make purchases and browse nft collections, like OpenSea (currently one of the largest nft marketplaces), BLUR, X2Y2, Looksrare, Foundation and Superrare can be used to buy NFTs.

Crypto Hot and Cold wallets

A hot wallet is connected to the internet, making it faster and more convenient to use, however it is at risk to online threats which could result in lost cryptocurrency.

A cold wallet is a secure way to store your digital assets, as it is not connected to the internet and the private keys are stored offline. While it offers an increased level of security, it is not as convenient as other types of wallets. One of the most popular cold wallets to keep you safe in nft world is Ledger Nano X.

Risks and Challenges of NFTs

Investing in NFTs is risky due to unpredictable profitability, the prevalence of fraud, and the lack of regulation. Additionally, NFT values can decline if they lack uniqueness or if similar versions flood the market.

Generally, investing in NFTs carries more risk than purchasing Bitcoin, however, there are some NFTs with lower levels of risk. Even if you diversify your NFT portfolio, the overall risk remains higher than investing in Bitcoin.

Non-fungible tokens (NFTs) face challenges and risks that may hinder their adoption. Building NFT-related solutions is complicated because the technology and tooling behind NFTs and decentralized applications are still new, and many complexities are not yet simplified.

What are NFT trading cards?

Blockchain networks are used to store digital items referred to as NFT trading cards, which can range from traditional sports cards to unique items such as NFT projects like CryptoPunks and Bored Ape Yacht Club unique assets. These rare digital items can be purchased, traded and exchanged between collectors and investors.

What Is Minting an NFT?

Minting an NFT is the act of generating a distinct and verifiable digital item, similar to a confirmation of authenticity, that is securely maintained on a blockchain and can be bought, exchanged, or utilized by the genuine owner.

Creating an NFT

Process of making an NFT is made relatively simple for NFT Creators. Users can select their desired content what their nft stand for, obtain a crypto wallet, choose an NFT marketplace, and follow the platform's instructions to mint NFTs. Once created, the NFT can be sent to friends or sold on NFT marketplaces.

Common Uses for NFTs

NFTs are primarily used to track ownership of digital art but have expanded to include real-world assets, virtual event tickets, certificates of authenticity, supply chain tracking, and in-game items as nft exchanges.

Pros and Cons of NFTs

Advantages of NFTs include fractional ownership, royalty payments to creators, secure technology, and efficient sales. Disadvantages include high minting costs, volatile pricing, and the risk of imitation and fraud.

Environmental Impact of NFTs

NFTs have been criticized for their negative environmental impact, as the blockchain technology used for storage emits a significant amount of carbon dioxide.

Conclusion

While NFTs offer an innovative way to own and trade digital assets, potential investors must weigh the benefits and risks associated with this emerging market. Understanding the legal implications, market dynamics, and environmental concerns can help individuals make informed decisions about participating in the world of NFTs.